ConickLaird is a wealth management specialist whose clients are individuals, their families, and sometimes their estates. Our function is to provide advice to our clients on all aspects relating to the management of their financial wealth.

Our objective is to grow the value of our clients’ wealth over time through a combination of careful structuring, asset allocation, investment selection and meticulous reporting through our portfolio administration service.

Advisers at ConickLaird have been providing advice and service to clients for many years and are highly qualified.

Learn MoreIn partnership with Perpetual Limited, ConickLaird provides a professional and convenient portfolio administration service.

Learn MoreConickLaird adopts a conservative and traditional approach to managing portfolios designed to achieve long term goals and objectives.

Learn MoreThere are a number of key points that underlie our service offering;

Our core service, the ConickLaird Private Wealth Management Service, encompasses:

Clients receive comprehensive income and capital gains tax statements annually assisting with taxation management. Detailed transaction reports are provided quarterly. We provide performance information allowing you to assess how your investments are performing relative to appropriate benchmarks.

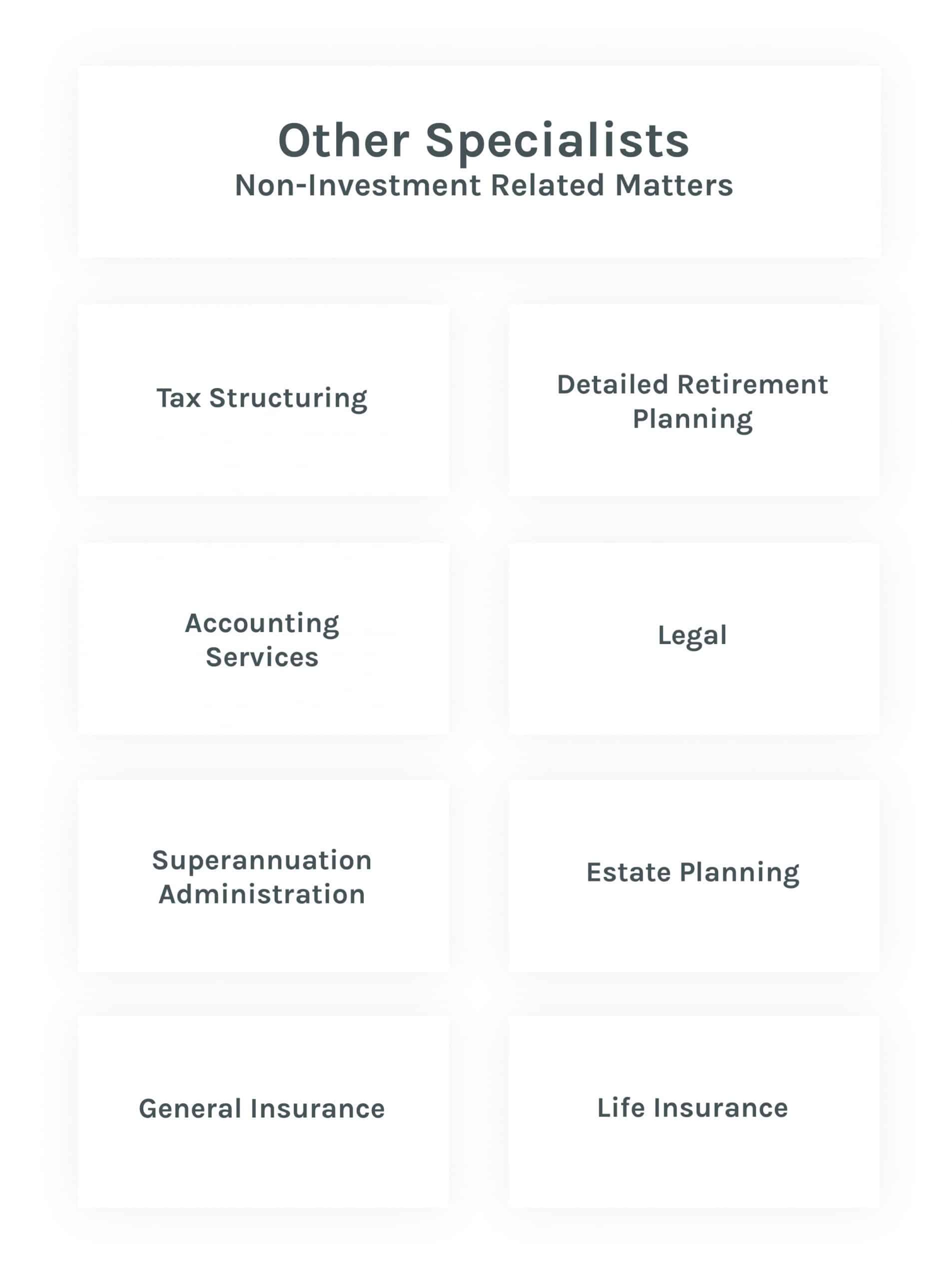

The following diagram illustrates how our approach might be applied when a comprehensive wealth management service is required. Some clients ask us to focus our service on specific components of this diagram.

When managing wealth all advice falls into one of two broad categories, investment related advice and non-investment related advice. ConickLaird will ensure your overall affairs are managed efficiently and professionally. Where external providers already exist or are required ConickLaird will work with them to ensure a cost effective, high quality solution.

ConickLaird holds an Australian Financial Services Licence. We are able to directly buy and sell listed investments and we are members of the Financial Planning Association of Australia.

ConickLaird have engaged Perpetual Limited to provide portfolio administration services to our clients. The following information gives an overview of this component of our service offering.

The portfolio administration service removes the tedious administrative tasks associated with managing an investment portfolio, allowing ConickLaird and our clients to focus on investment strategy. With the administrative issues addressed we are able to focus on what to buy, sell, retain or transfer and through what structure.

Perpetual provide custody of your assets and administer all transactions. Clients are able to review portfolios with clear, detailed and consolidated reports – designed to be streamlined and easy to read.

Perpetual has the technology and processing capability to handle a wide range of assets. Perpetual’s investment administration capabilities apply to most types of portfolio assets including:

Perpetual’s Portfolio Administration Service caters for any ownership structure. This includes trusts, private companies, superannuation or pension funds and individual or joint ownership structures. If more than one ownership structure is used to hold investments, reports are provided on each account separately and Perpetual also provide a consolidated view of all ‘family group’ investments.

Clients can nominate how accounts are to be consolidated and other related accounts (such as a spouse) can be included in these consolidated reports. In addition, there is the flexibility to specify how certain fees are to be allocated within a family group of accounts.

Upon establishing an account portfolio information can be accessed online. The information available includes but is not limited to:

The first step in our wealth management process is to develop an appropriate asset allocation for each client. Asset allocation is a term used to refer to how an investor distributes his or her investments among various classes. At ConickLaird we focus on the main asset classes of shares, property, bonds and cash.

The next stage of our wealth management process involves ConickLaird recommending specific investments within asset classes.

Once the initial portfolio is implemented, we administer, monitor and manage individual portfolios on an ongoing basis. This includes a formal face to face review meeting each year to present key information such as income, capital growth and total deposits/withdrawals.

We have listed below some key characteristics of our approach to portfolio/wealth management

Oliver Conick is a founding Principal of ConickLaird and is joint Chief Executive with Andrew Laird. Prior to the establishment of ConickLaird Oliver was a Director at UBS Australia and held a senior position in the Private Client department. Oliver was a client adviser and head of the Sydney office as well as holding a position on the country management committee. Prior to joining UBS in March 1998 Oliver had been employed by the MLC group for eight years. In addition to the qualifications below Oliver is a Certified Financial Planner.

Andrew Laird is a founding Principal of ConickLaird and is joint Chief Executive with Oliver Conick. Prior to the establishment of ConickLaird Andrew was employed by Goldman Sachs JBWere and held a senior position in the Private Client department. Andrew was a client adviser in the Sydney office and focused on high net worth individuals. Prior to joining Goldman Sachs JBWere in January 1998 Andrew had been employed by the BT Group for two years and the MLC group for six years. In addition to the qualifications below Andrew is a Certified Financial Planner.

John Laird has over 30 years of experience as a consultant and adviser to the investment/stockbroking industry. Prior to this John held senior roles in Australian and global financial markets with major Australian and overseas based financial institutions and investment banks. John advises on a wide range of investment portfolios including superannuation funds, incorporating listed and unlisted securities in both the Australian and global financial markets.

John Charrington has over 35 years of experience in the investment/stockbroking industry, the last 15 being with UBS Private Wealth Management. While at UBS, John specialised in providing individuals, family trusts, superannuation funds and charities with investment advice. Following his retirement from UBS, John has been consulting within the investment industry in Australia and New Zealand. He sits on the board of two foundations and for ten years was on the board of a school foundation, nine of which were spent as Chairman.

T 02 9222 9934

M 0422 614 964

T 02 9222 9116

M 0411 444 266

T 02 9222 2688

M 0402 476 101

T 02 9222 2688

M 0410 665 781